Resources

These tools are designed to help an employer make informed decisions regarding their current 401(k) plan.

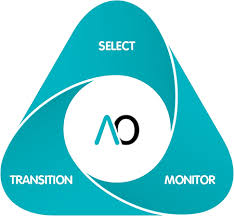

The goal of the OPEN 401(k) is to provide employers with a complete turnkey solution.

The goal of the OPEN 401(k) is to provide employers with a complete turnkey solution.